Casino Revenue Vs Online

Today we will consider two crucial money-related key performance indicators (KPIs) that speak of the online casino profits: Gross Gaming Revenue (GGR) and Net Gaming Revenue (NGR).

What is the difference between these KPIs and how to calculate them, you can find out in the material prepared by the experts of Slotegrator.

Calculation formulas

GGR is a financial indicator that shows the amount of money gained by the casino as a result of players' activity, but before deduction of additional casino expenses. It has a simple formula:

GGR = A - B.

NGR is a financial figure that determines the basic profits share collected by the casino at the end of the month. It is defined by the following formula:

NGR = A - B - C - D.

Legend:

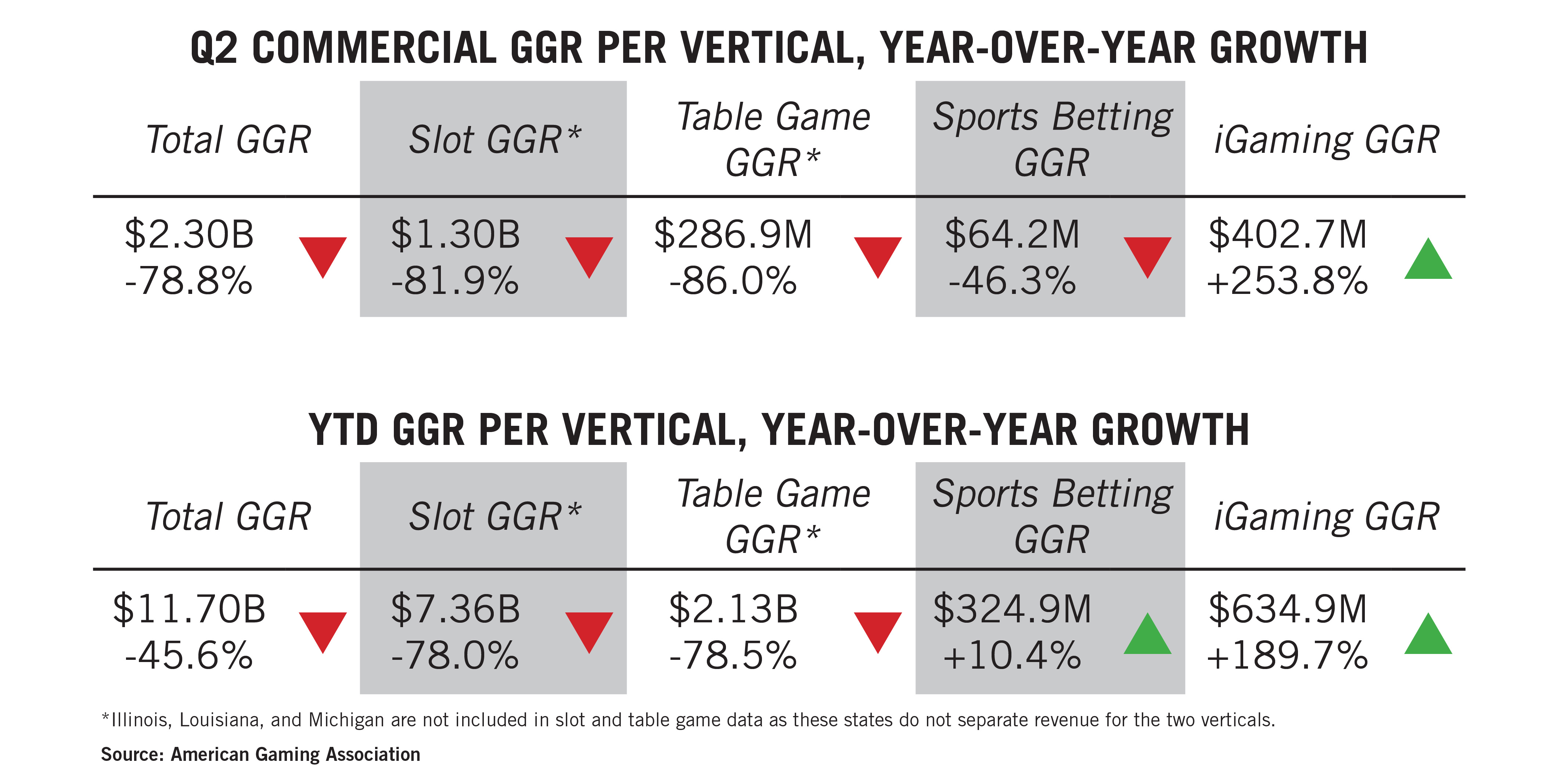

They generate more than 50% of casino revenue, easily 60%, 70%. Casinos usually do not earn much from multiplayer games like Baccarat, Blackjack, Roulette. In 2017, Gross Gaming Revenue reported by US casinos was $41.2 billion. But what exactly is this Gros s Gaming Revenue? GGR, as it’s usually abbreviated in the online casino and gaming industry, is a measure of profit. The profit comes from the difference between the cash players bet and the cash they win. Here is a list of Atlantic City casinos revenue reported by the New Jersey Division of Gaming Enforcement.The tables reflect activity at land-based activity and does not include NJ online casino revenue. Read more about NJ online gambling revenue and NJ sports betting revenue. Last updated: November 2020 Atlantic City gambling revenue, October 2020.

A – total amount of all bets placed by players;

B – the sum of all payments to players;

C – the sum of all bonuses received by players;

D – the total of all taxes.

GGR does not include bonus payments and taxes. Therefore, this indicator is often used in calculation of tax deductions. As a rule, the amount of tax is a given percentage of the GGR.

NGR is a measure of a gambling establishment's net revenue minus all payments to players and tax deductions, but excluding operating expenses. It is usually used to analyse business profitability, dividends payments, etc.

However, there is no generally accepted approach to the definition of NGR. It has to do with the fact that this indicator is used in monitoring business profitability but has no ties to mandatory payments. For example, operating, marketing and other expenses may or may not be deducted from the total amount of bets when calculating NGR. Therefore, throughout the business planning, it is important to decide what formula to use.

Pennsylvania Casino Revenue

Example

For better understanding, let's look at some fictitious online casino, Good Luck, registered in the UK. The given jurisdiction regulates online gambling with a 15% tax on GGR.

In the span of a year, the players of Good Luck made bets on $5 million, and won $2.5 million. At the same time, they received a total of $700,000 as various bonuses.

Thus, the value of A = $5,000,000; B = $2,500,000; C = $700,000.

GGR = $5,000,000 – $2,500,000 = $2, 500,000.

The value of D, according to the specified tax rate, will be equal to the tax base multiplied by 15%.

D = $2,500,000 * 15% = $375,000.

Consequently

NGR = $5,000,000 – $2,500,000 – $700,000 – $375,000 = $1,425,000.

Net Gaming Revenue of the online casino Good Luck totals $1,425,000 for the year.

Here, NGR does not include operating expenses as royalties to providers, payments to affiliates, commissions of payment systems, staff salaries, etc.

Conclusion

Despite being at its nascent stage, the online gambling industry shows the essential rates of growth. And the market, according to experts, has great potential. The Slotegrator experts admit that there are more and more entrepreneurs willing to start own online casinos today.

By taking a decision to kick off own online gambling projects, many investors focus only on total deposits and winnings of players. However, there are other indicators to analyse the gambling project performance. Therefore, for your project success, it is important to understand the difference between those KPIs, the purpose of each, as well as to conduct an in-depth analysis.

Imagine traveling back in time to 1970. There, you play a word association game starting with “casino.” The response would be nearly unanimous: some form of “gambling.”

If you were to conduct the same experiment today, the overwhelming majority would still say “gambling,” but you’d also get many other responses. From dining to nightclubs, and from shopping to shows, casinos have radically changed their stripes during the past decade or so.

Casino Revenue By State

And ten years from now, the number of people who associate casinos with gambling will continue to drop, as casinos continue to shift the way they’re doing business.

Increased competition leads to a shift in thinking

With casinos proliferating across the country, the competition for customers’ dollars kicked into overdrive.

For a while, casinos decided to stick with the business model that had served Las Vegas and AtlanticCity well for many years: Give potential customers perks to come and gamble.

But much like airline fare wars of the past — where airlines would simply undercut competitors’ rates — at some point their profit margin disappears. They’re more or less giving away $100 to get someone to gamble $50.

As with the airlines, the numerous perks simply turned into a bidding war between casinos. Had this continued, it would have led to a profit drought.

Faced with an untenable situation, a number of casinos made some difficult and risky changes. Instead of value, they offered luxury. Casinos began to realize they couldn’t simply offer gambling and expect people to show up.

The new casino experience

Now casinos are going in the opposite direction. Instead of cheap rooms and loss-leading buffets, they’re charging visitors through the teeth for those rooms and plying them with high-end eateries, expensive shows and bottle service in their clubs.

Some have described this as penny-pinching and less value for the visitor. However, in my estimation, it’s something altogether different. It’s a new business model that’s selling people an experience and a status.

Instead of catering to the value hunters, casinos are no catering to the spendthrifts — the people willing to splurge for a once-in-a-lifetime experience.

And it’s working.

Hotel rooms are more valuable than slot machines

Gaming, once the be all end all of casino revenue, now represents just one third of total Las Vegas Strip revenue.

As UNLV’s David Schwartz recently wrote:

“If the current trend continues, by 2019, rooms will make about as much money as the casino floor, in 2020 they will surpass it, and by 2023, Las Vegas Strip resorts will make about $2 billion more from their rooms than their gambling.”

Schwartz noted that gaming revenue was down $600 million in 2016, compared to 2007, but room revenue was up $800 million.

These numbers are indicative of the idea that casinos have long undervalued their hotels and amenities. They used to give them away as door prizes to anyone who set foot on the casino floor.

As it turns out, the four- and five-star hotels are the real attraction.

Shifting away from gambling is good for everyone

States initially turned to legalized gambling to bring in new revenue. But because of the saturation of the market, existing casinos saw revenues sag as new, swankier venues opened. This led to layoffs, and in some locales (see Atlantic City in New Jersey) closures. This can have a devastating impact on a local economy.

States are now trying to mitigate the potential negatives, and in doing so they’re almost forcing the casino industry’s hand and accelerating the shift toward non-gaming revenue.

Nowhere is this more evident than in Massachusetts.

Massachusetts casinos are playing by a different set of rules

Massachusetts casinos are bucking every piece of traditional casino wisdom.

When Massachusetts authorized casinos in 2011, it was a given that gaming would be handled differently in the Bay State. What Massachusetts ended up doing was building on the successes of its gaming predecessors and creating a completely new way of doing things — what I’ve dubbed the Massachusetts Model.

The Massachusetts Model is extremely comprehensive. It fosters not only the casino itself, but integrates the casino into the local economy through jobs, development and economic stimulus.

Turning casinos into economic drivers

From the procedures governing licensing, to robust regulations, to responsible gaming programs, everything Massachusetts is requiring its casinos to do is meant to maximize the benefits casinos offer and minimize the negatives.

This means: Keep the focus on non-gaming revenue streams.

The Massachusetts Model is evident in every step of the casino process. It starts with the way casinos had to approach licensing and work with the host community.

Instead of inviting continued competition, winning Massachusetts casino proposals have exclusive rights to a “zone.” But that doesn’t mean there wasn’t competition.

First, the proposal needed to guarantee a set minimum investment. Next, it needed to be good enough to win over the host community — elected officials and a voter referendum. Finally, it had to be good enough to be chosen over the other casino proposals from that zone.

The competition was in the project, but once a casino was granted a license, it had exclusive rights to that area. Massachusetts sees this not as a path to future complacency. Rather, it is a highway to continued reinvestment, since a company isn’t going to dig a billion-dollar hole in the ground and let it slide into disrepair.

In short, the Massachusetts Model ensured winning casino proposals invested in the project for the long haul.

The casinos of the future will offer gaming the ‘right’ way

The Massachusetts Model also extends to the casino floor.

Casino operators are discovering the gaming environment in Massachusetts is much different than in other jurisdictions. Any company focused solely on gaming revenue would find Massachusetts inhospitable. But, for the casino corporations that are out in front of the zeitgeist, Massachusetts is simply a glimpse into their, and the industry’s, future.

Massachusetts casinos are non-smoking (often seen as a death knell in the casino world). They use innovative responsible gaming programs that the industry has long fought against. (They were widely believed to depress gaming spend.)

But Massachusetts insisted, believing that while the programs might stunt gaming revenue, it was integral to the other parts of the Massachusetts Model working.

It would be undermined without it, as casinos might be tempted to return to their old ways. That would mean going after the low-hanging fruit (gaming) instead of continuing to reinvest in their properties and turning them casinos of the future where hotel, retail, dining and entertainment far outpace gaming revenue.

The early indications point to the Massachusetts Model going over well. MGM (which hasn’t even opened the doors of its Massachusetts casino) has decided to incorporate one of the responsible gaming programs, GameSense, into all of its casinos nationwide by the end of the year.

Final thoughts

The casinos of the future will still be heavily invested in gambling, but gambling will not be the sole focus. It will be symbiotic with other entertainment options and feature a focus on responsible gaming.

Online Gambling Revenue

Image credit: Usa-Pyon / Shutterstock.com